The first iteration of crowdfunding under Rule 506(c) enabled companies to solicit from the general public on the condition, amongst other things, that only accredited investors would be qualified to be solicited. Despite hundreds of online platforms launching to “democratize” venture and early stage investing to the accredited general public, results were mixed, at best.

Online platform after online platform were launched, pitching investors and issuing companies alike on the promise and dream of a more direct and efficient path to capitalization. Under the new framework of general solicitation, the path to capitalization would now be truly democratized.

However, as it turned out, one of the chief complaints to the 506(c) framework was that it didn’t really democratize this early-stage and venture investing (given that non-accredited investors were excluded) and it put an extra burden on issuing companies to be able to verify that the investors that they were soliciting were, in fact, accredited.

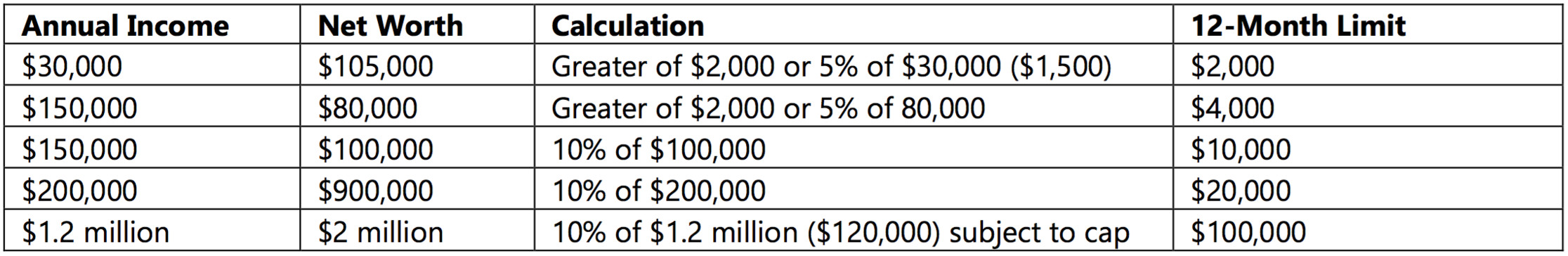

Now, capital markets participants on all sides are looking forward to May, where, under recently adopted rules, companies will be able to broaden their solicitation further, to include non-accredited investors, with the qualification, amongst other things, that investors are limited in how much they can invest during any 12-month period in these transactions. The limitation on investment is based on net worth and annual income.

Takeaways and Considerations – Score One for Democracy?

Starting in May, for the first time, anyone can invest….literally. However, the caveat is that you may be limited to the greater of either $2,000 or 5% of the lesser of your annual income or net worth if you are either earning less than $100,000 annually or your net worth is less than $100,000. So you may not be able to invest with “force”, but you can still participate.

This probably isn’t a bad thing either. Consider the fact that even the “pros”, managed fund and venture capital firms typically anticipate “fail rates” of 60% to 70% in early stage venture investing. And these firms are getting access to the best, the hottest issues – the kind of deals that get pitched on Sand Hill Road. It stands to reason that the “fail rates” might be even higher when you factor in all of the offerings being undertaken online under the new rules, which may not have the benefit of seasoned management teams, disruptive technologies, and other unfair competitive advantages that are typical characteristics of the 1% of firms that actually receive capital from the establishment venture capital community.

When you think of that way, “Joe Six-Pack” investing $2,000 and a fail rate of 60%+ looming, will need to pony-up an additional $4,000 or so for a couple more investments to try an match the success rate of conventional venture capital, and on an after-tax adjusted basis, this translates into roughly 8% of Mr. Six- Pack’s take-home income.

The problem is that $2,000 is the limit, in this situation, in a particular year – period. In which case, Mr. Six- Pack, being sensitive to risk and realistic about the fail-rate, might want to adjust his investments to $666 into three deals, or $200 into ten deals – hardly living the dream.

Investors with income and net worth in excess of $100,000 are better equipped to deal with the risk of loss, so the 12-month investment limits increase. The SEC provides the following example:

For issuing companies, under the new framework, the burden of verification is loosened, but now they are dealing with another unhappy consequence. They may be faced with a legion of small investors capped by the amount they can invest, which translates into a much larger administrative and investor management burden, not to mention an unwieldy cap table.

Let’s say that an issuing company is raising $2 million under this new crowdfund framework. If we assume that the participating investors are limited to $2,000, the implication is that the company would be taking on 1,000 new investors. As noted above, this can wreak havoc administratively, not to mention the chill it can have on future rounds of financing as the company moves upstream.

If the company wanted to limit this possibility, it might make the minimum investment, say $20,000. But then it still ends up with 100 investors, and important to this discussion, it has materially chipped away at the democratization of investing that this whole JOBs Act framework was supposed to enable.

A Common Workaround May Not Get the Work Done for the Little Guy

One way to side-step this problem, in part, is for the issuing company to work with a special purpose vehicle (SPV), which is formed to raise capital, for the purpose of investing into the company. Functionally, the SPV represents a single shareholder, where the general partner typically acts as the liaison between the company and the limited partners invested into the SPV.

But this doesn’t get us out of the woods. The SEC limits an LLC to having 99 investors. But, assuming 99 investors, each investing $2,000, the SPV is limited to a $198,000 investment into the company, falling far short of the target raise of $2 million.

The SPV can raise the minimum investment to $20,000 and just about make the entire investment, maxing out at 99 investors, which may solve the headache for the issuing company, but it doesn’t help Mr. Six- Pack. He is still on the outside looking in.

So it appears that democracy is still a work in progress. The point here is not to suggest that crowdfunding is a broken promise (at least for issuers) or that there isn’t tremendous potential for more investors to participate in ways that they had previously been unable.

Rather, the point for the small investor, limited in the amount of risk capital (and it is risk capital) they can invest, is that you still might find it challenging to participate in ways that you might have hoped. Your access to venture investing is likely to continue to be impeded by practical as well as regulatory constraints that issuing companies face. For these investors, Regulation A Crowdfunding is likely to be a more attractive option, but that is a topic for another discussion.

The point for issuing companies is that no two offerings are the same and that there is much to consider, strategically and architecturally, when determining whether and which crowdfunding framework is appropriate, if at all.