In a groundbreaking development, Bitcoin has officially become the world’s 10th largest currency by market capitalization, surpassing numerous fiat currencies and solidifying its status as a key player in the global financial system. This milestone underscores Bitcoin’s growing adoption and its role as a store of value in the evolving digital economy.

A Milestone in Cryptocurrency History

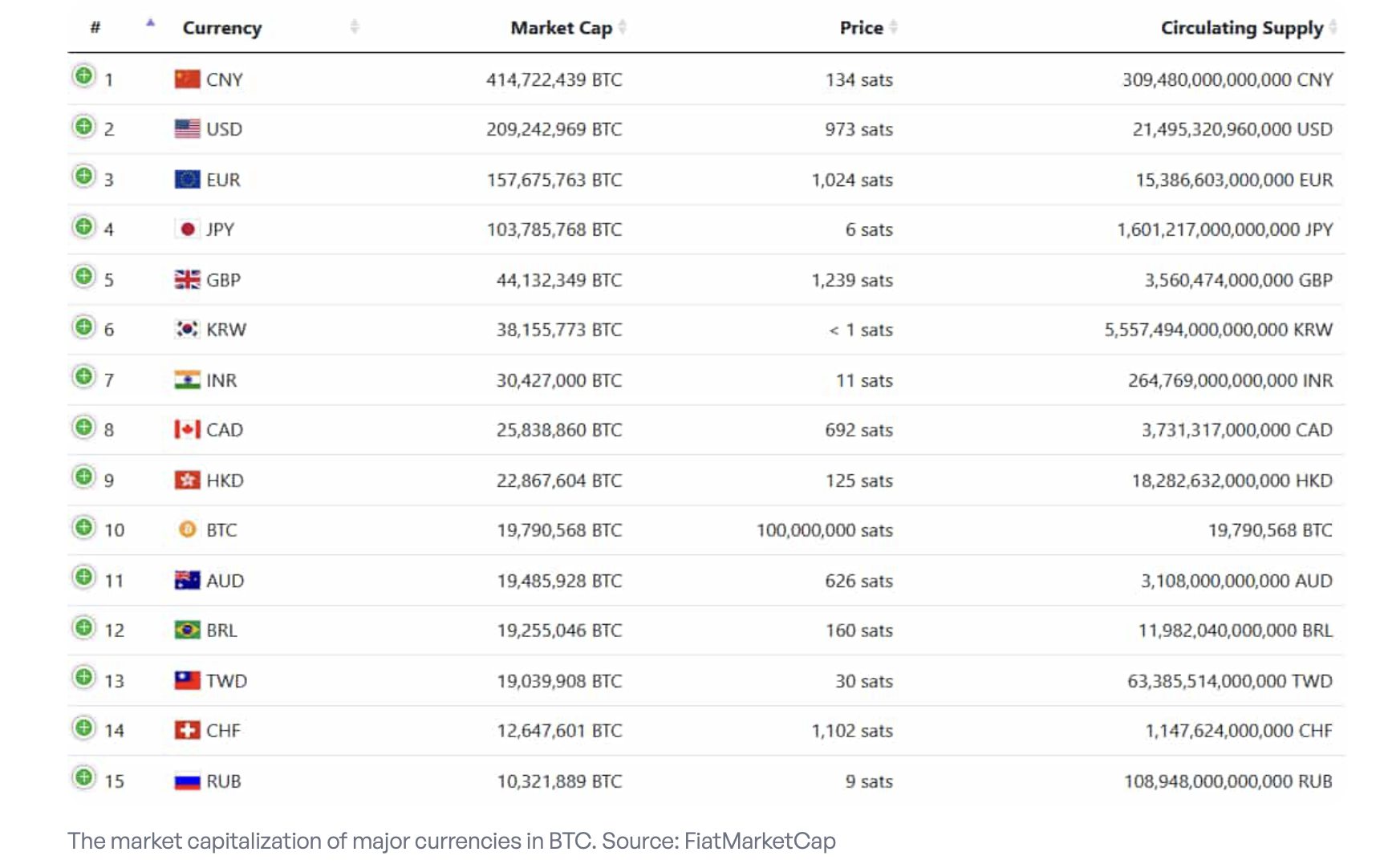

According to recent data, Bitcoin’s market capitalization has reached levels comparable to major national currencies, outperforming traditional currencies like the South Korean won, the Russian ruble, and the Mexican peso. As of now, Bitcoin sits just below the Indian rupee and the Canadian dollar, making it the only non-sovereign currency to rank among the top 10 globally.

This achievement is particularly noteworthy given Bitcoin’s decentralized nature and its emergence just over a decade ago. Unlike fiat currencies, which are issued and controlled by governments, Bitcoin operates on a peer-to-peer network powered by blockchain technology, making it resistant to censorship and centralized control.

The Numbers Behind Bitcoin’s Ascent

Bitcoin’s market capitalization currently exceeds $900 billion, a figure that reflects its widespread adoption by both retail and institutional investors. This growth has been fueled by increasing interest from hedge funds, corporations, and even nation-states. For context:

- The South Korean won, ranked just below Bitcoin, has a market cap of approximately $850 billion.

- Bitcoin’s current supply is capped at 21 million coins, which contrasts sharply with fiat currencies that can be printed at will.

The rise of Bitcoin is also linked to its ability to serve as a hedge against inflation, a role traditionally held by assets like gold.

Why This Matters

Bitcoin’s entry into the top 10 currencies challenges the traditional financial system and highlights a shift in how value is stored and transferred globally. This development has significant implications:

- Validation of Digital Assets: Bitcoin’s achievement lends credibility to the broader cryptocurrency market, encouraging mainstream adoption and innovation in the space.

- Economic Inclusion: Bitcoin’s borderless and permissionless nature makes it accessible to millions of unbanked individuals worldwide, providing an alternative to traditional banking systems.

- Investment Diversification: With institutional investors increasingly viewing Bitcoin as “digital gold,” its role in diversified portfolios continues to grow.

The Road Ahead

While Bitcoin’s ascent to the top 10 is remarkable, it is not without challenges. Regulatory scrutiny, price volatility, and environmental concerns related to mining remain significant hurdles. However, ongoing developments, such as the adoption of renewable energy for mining and the implementation of Layer 2 solutions like the Lightning Network, aim to address these issues.

What’s Next for Bitcoin?

As Bitcoin continues to gain traction, its role in the global financial system will likely expand. Possible future scenarios include:

- Increased Sovereign Adoption: Countries like El Salvador have already adopted Bitcoin as legal tender, and others may follow suit, particularly in regions with unstable currencies.

- Integration with Traditional Finance: Major financial institutions are integrating Bitcoin into their services, from custody solutions to exchange-traded funds (ETFs).

- Technological Advancements: Upgrades to the Bitcoin network could enhance scalability, security, and usability, further cementing its position as a leading digital asset.

Conclusion

Bitcoin’s rise to the 10th largest currency in the world marks a pivotal moment in the history of finance. It not only demonstrates the disruptive potential of blockchain technology but also reflects a growing demand for decentralized and inflation-resistant assets. As Bitcoin continues to evolve, it may pave the way for a more inclusive and resilient financial ecosystem.

For those interested in learning more about Bitcoin and its implications for the future of finance, visit Deal Box and follow us on LinkedIn, Instagram, and Facebook.