Since September 23, 2013, the inauguration date of the ability for companies to raise money through general solicitation under Regulation D Rule 506(c), the promise of crowdfunding has steadily grown. Implementation has been choppy, at best as issuers and intermediaries work through regulatory uncertainties, and as investors interested to participate have had to sort through the cluttered landscape of web-based equity marketplaces. To be sure, crowdfunding is a well-entrenched term. A simple Google search shows more than 26 million results.

To try to get a better sense of where the Rule 506(c) market is headed, it is helpful to look at the back data. In this article, we will make use extensively of an October 2015 published report[1] from analysts at the U.S. Securities and Exchange Commission which have been tracking unregistered securities offerings closely over the last several years.

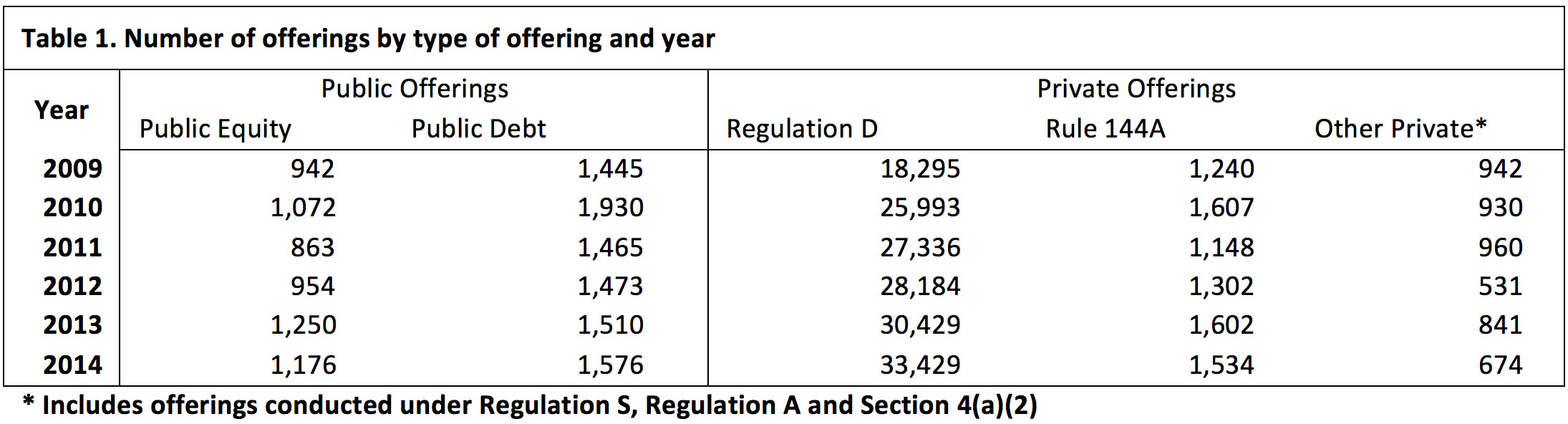

In 2014, more than $1.3 trillion was raised in the Regulation D market in 33,429 offerings. Of that, $133 billion, about 9.9% was raised by non-financial issuers (operating) in 12,389 offerings.

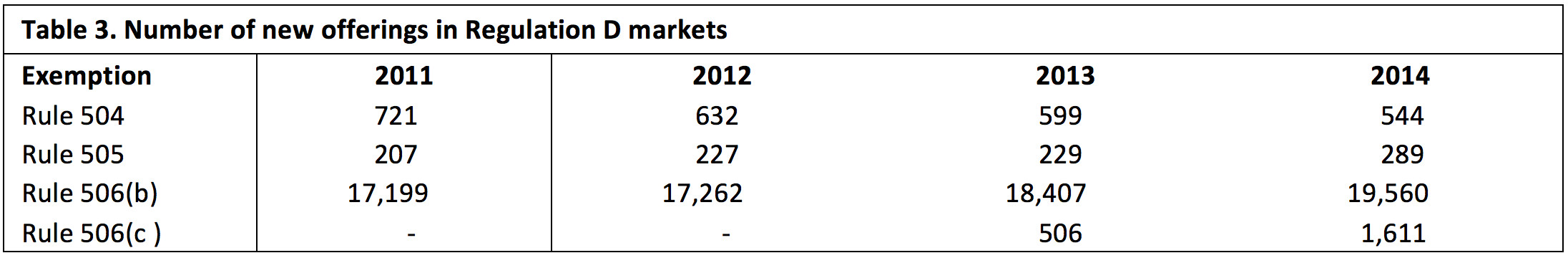

Based on reported data through Form D filings, the number of unregistered offerings has been steadily increasing over the last several years.

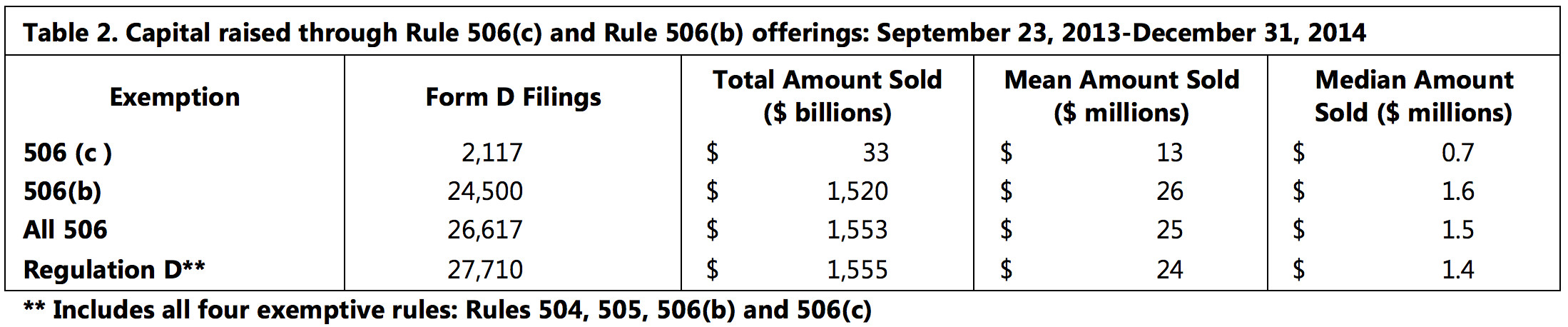

Since the effectiveness of Rule 506(c) through December 31, 2014 $33 billion (about 2%) of the capital raised in Regulation D offerings was conducted pursuant to Rule 506(c).

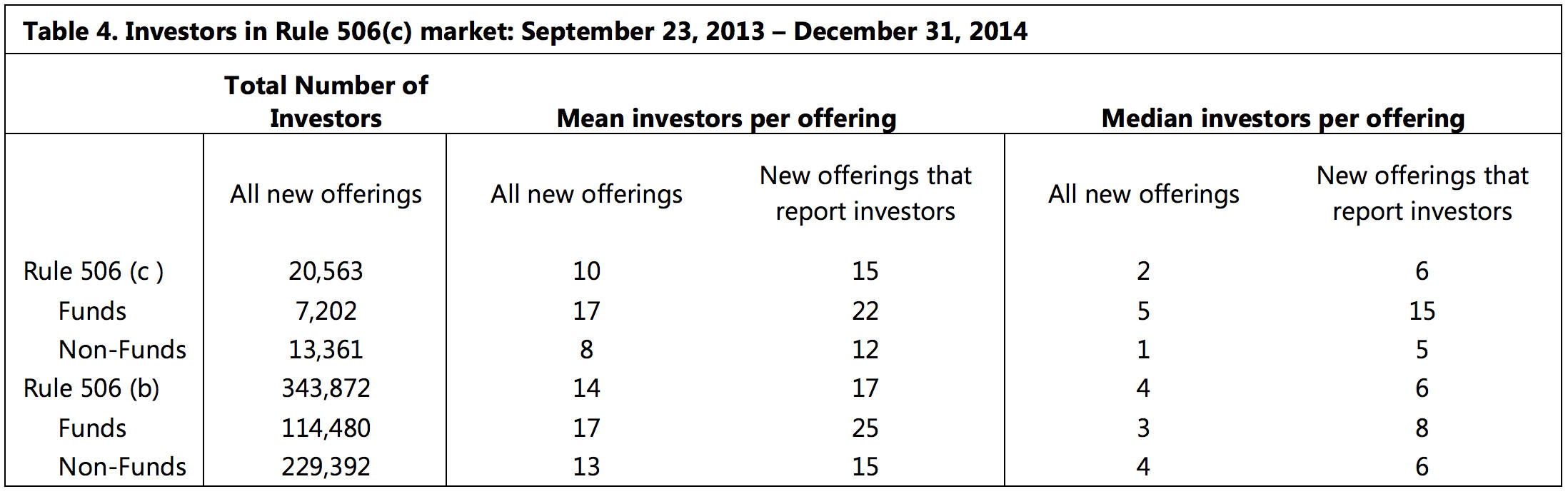

As of December 31, 2014, more than 5,200 investors participated in Rule 506(c) offerings since the rule’s effectiveness. The average number of investors per Rule 506(c) (10) is smaller than the average number of investors in a Rule 506(b) offering (14), which could be attributed to the fact that less money is being raised.

Keep in mind that Rule 506(c) prohibits non-accredited investors from participating, and with Rule 506(b) participation is limited to 35. And accredited investors make up less than 1% of the U.S. population. That rules out a significant portion of the investing public from participation.

Perhaps the biggest takeaway from the data above is that the accredited crowdfunding market is still in its nascent stages and being figured out by investors. To be sure, on a percentage basis, it is the fastest growing of the Regulation D markets. And to be fair, the Regulation D data for 2015 is not yet reported the analysts at the Securities and Exchange Commission which prepared the data above. So we expect that the trend for participation in Rule 506(c) offerings will continue to be moving higher.

What about Regulation A?

Historically the Regulation A framework value proposition wasn’t compelling and therefore was little used. In connection with a hearing before the House Committee on Financial Services on December 8, 2010, regarding amending the Regulation A offering threshold to $30 million, William R. Hambrecht, Chairman and CEO of WR Hambrecht + Co. commented that “according to public records, since 2005 there have only been 153 Regulation A filings and of those 153, an astoundingly low number of 13 have actually priced.”

Many market watchers, prospective issuers and intermediaries are looking forward to the newly revamped Regulation A (“Regulation A+”) as another compelling driver of capitalization for emerging growth companies. The fact is that historically, only accredited investors (individuals who make more than $200,000 in income or who have $1 million in assets (excluding primary residence)) have been able to invest in startups.

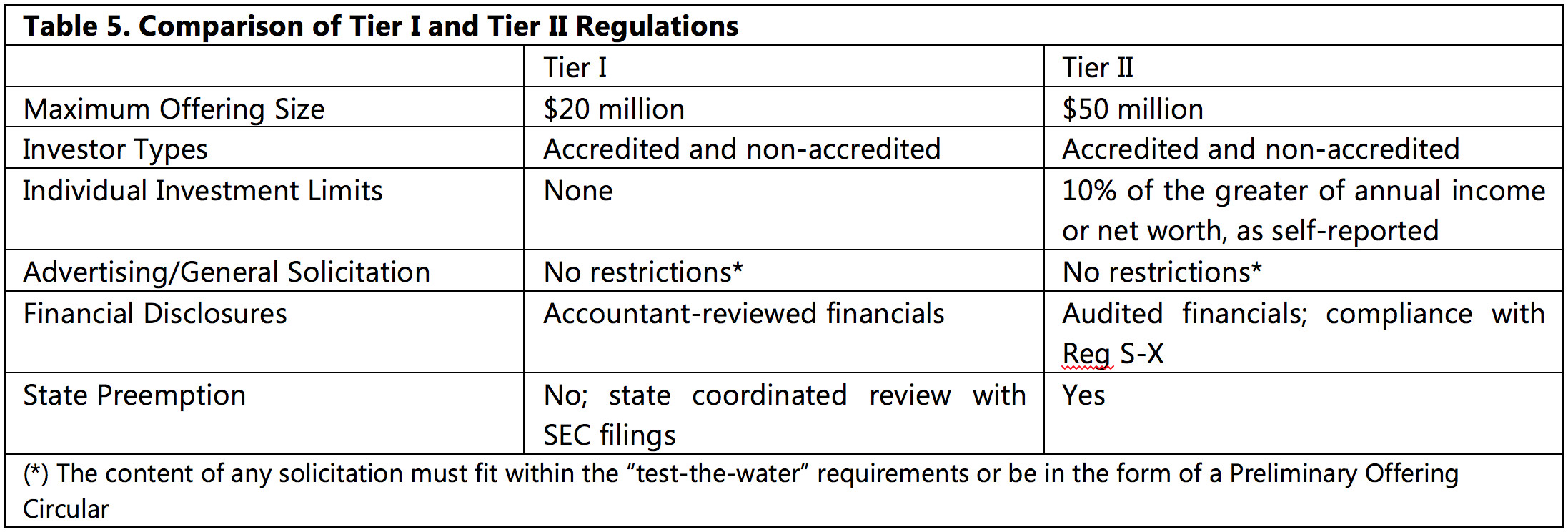

Regulation A+ enables issuing companies to raise up to $20 million on Tier 1 and up to $50 million on Tier 2 from accredited and non-accredited investors.

Regulation A+ is not a private offering, but rather, more of a “mini-registration”, in that the issuer has to prepare and file an offering statement for the SEC, deliver the offering statement to prospective investors and file periodic reports of sales after completion of the offering. With this level of disclosure and oversight, the SEC is satisfied that the level of risk to non-accredited investors is appropriately mitigated. That doesn’t mean risk is eliminated, and that they can’t still lose their entire investment.

But one general takeaway at this point is that Regulation A+ offerings could actually fulfill the promise of crowdfunding to actually “democratize” investing to all. Start-ups and emerging companies can tap into the investment potential of the masses. However, the process is more complicated (regulatory rules and restrictions in addition to the filing process) and carries additional material expense ($50,000 to $100,000). And at the end of the day, there is still no promise that the offering will fully subscribe.

Looking forward to 2016

As issuers become clearer about the regulatory and compliance environment surrounding Rule 506(c) offerings, as online marketplaces gain credibility amongst issuers and investors, and as investors become more comfortable with the Rule 506(c) process, we expect to see continued growth in Rule 506(c) offerings and monies raised.

Consider this:

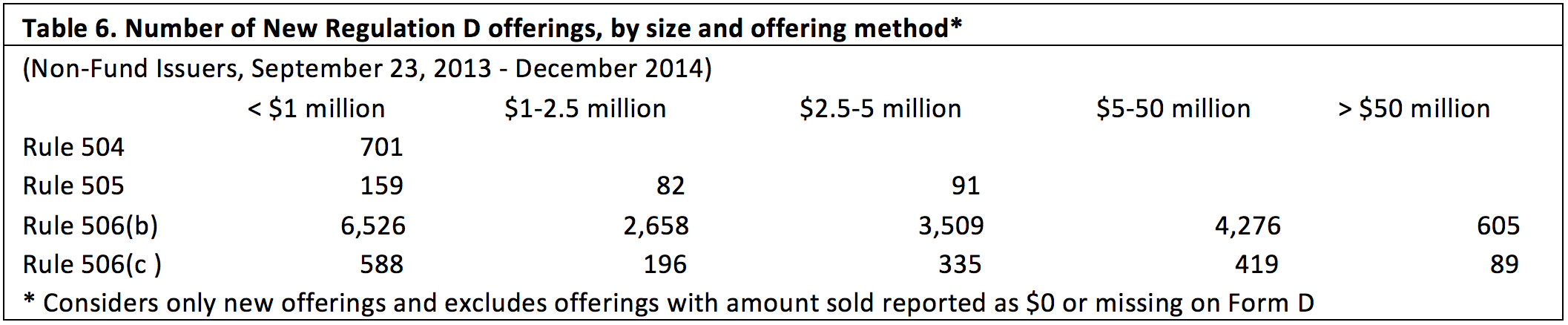

At December 31, 2014, Rule 506(c) offerings represented 7% of the total number of Regulation D offerings. If we assume no growth in Rule 504 and Rule 505 offerings in 2015 and 2016, and 6% growth in Rule 506(b) offerings, and 40% and 30% growth in Rule 506(c) offerings over the same period, respectively, then Rule 506(c) offerings would account for 11% of the total number of Regulation D offerings and an upper bound of $63 billion in capital raised. All things being equal, non-fund issuers would capture $21 billion of this.

And then there is Regulation A+. Some advocates are forecasting that Regulation A+ will become a form of crowdfunding (“crowdfunding plus”). It remains to be seen, however, whether Regulation A+ will make sense to the majority of issuers that would otherwise employ a Regulation D Rule 506(b) or Rule 506(c) offering.

After all, the median offering size for Regulation D Rule 506(c) offerings is less than $2 million, consistent with the intent of Regulation D to target the capital formation needs of small business.

The good news, and bottom line, is that the capital markets have never been more accommodative to both issuing companies and investors alike. That doesn’t mean there aren’t still important and needed changes, but it does mean that companies seeking to raise capital in 2016 will have more options to access broader investment sources.

[1] See Vladimir Ivanov, Senior Financial Economist, U.S. Securities and Exchange Commission, “Capital Raising Through Regulation D (2015).