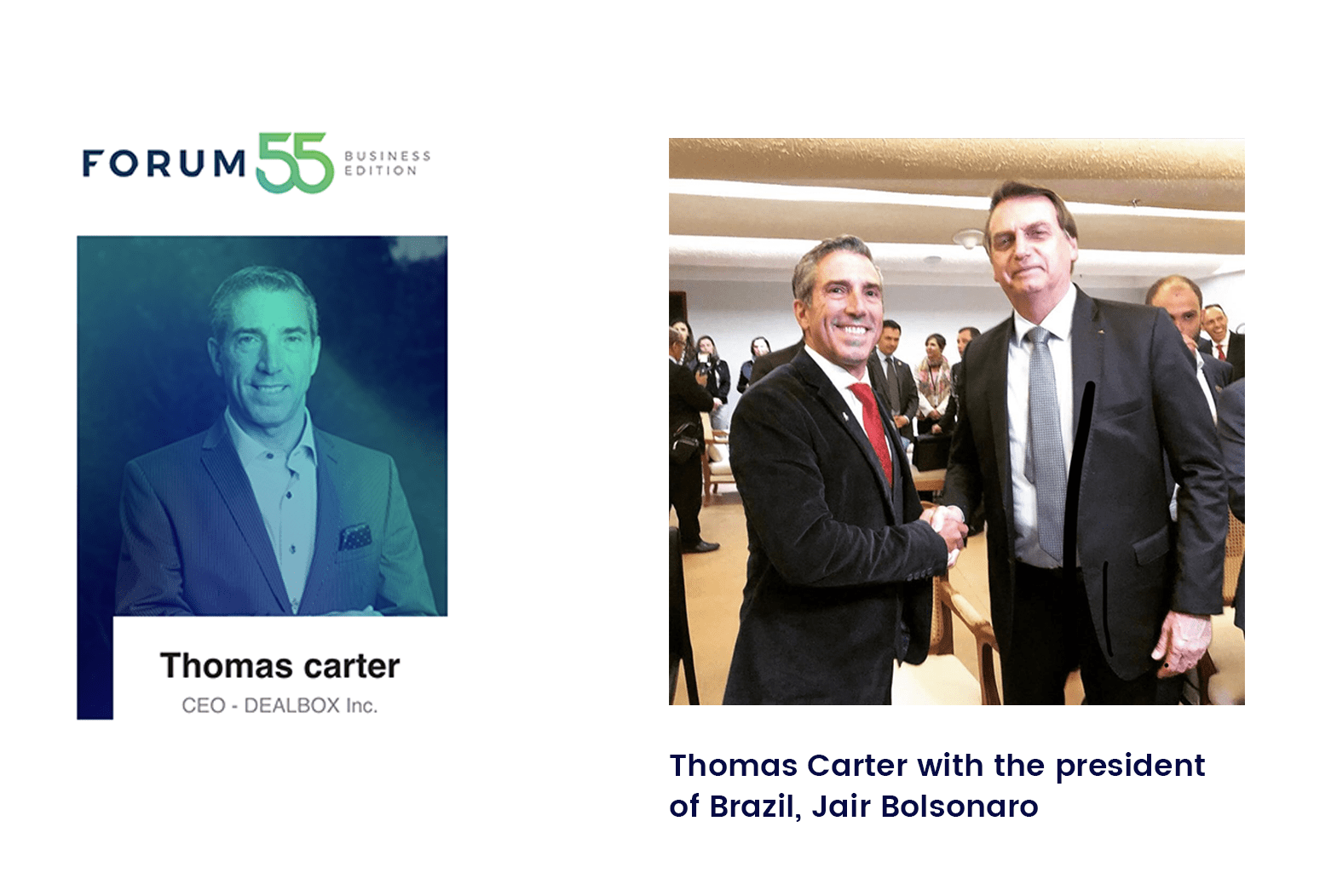

July 24, 2019 Brazil Security Token pioneer and CEO of DealBox Thomas Carter along with other world-renowned business luminaries, is presenting at the Forum 55 entrepreneurial networking event held at theUlysses Guimarães Convention Center in Brazil from July 24 to July 27th. In attendance is Brazilian president, Jair Bolsonaro who has pledged to streamline rules for entrepreneurs and create a…